Initial Coin Offerings

In this section we are looking at the role of initial coin offerings as an investment opportunity.

At Yknot Blockchain Solutions we often use a sailing metaphor to explain the concepts and terms related to blockchain technology. We would say that pursuing ICO investments are like venturing out to distant lands in search of undiscovered gems. The tokens that you stake will determine your stake in the treasure.

Let’s explain it in technical terms.

In this new token-economy, initial coin offerings (ICO) are the cryptocurrency industry’s equivalent to an initial public offering (IPO) [1].

Companies launch an ICO when they need to raise money to create a new coin, app, or service. Interested investors can buy into the offering and receive a new token issued by the company. This token may have some utility in using the product or service the company is offering, or it may represent a stake in the company or project. These tokens are similar to shares of a company sold to investors during an IPO [1].

ICO is a popular fundraising model among companies, primarily start-ups, that are developing their offering of products and services, usually related to the blockchain space. ICO's are largely unregulated, without exchange commission oversight.

Static Pool or Dynamic Pool ICO

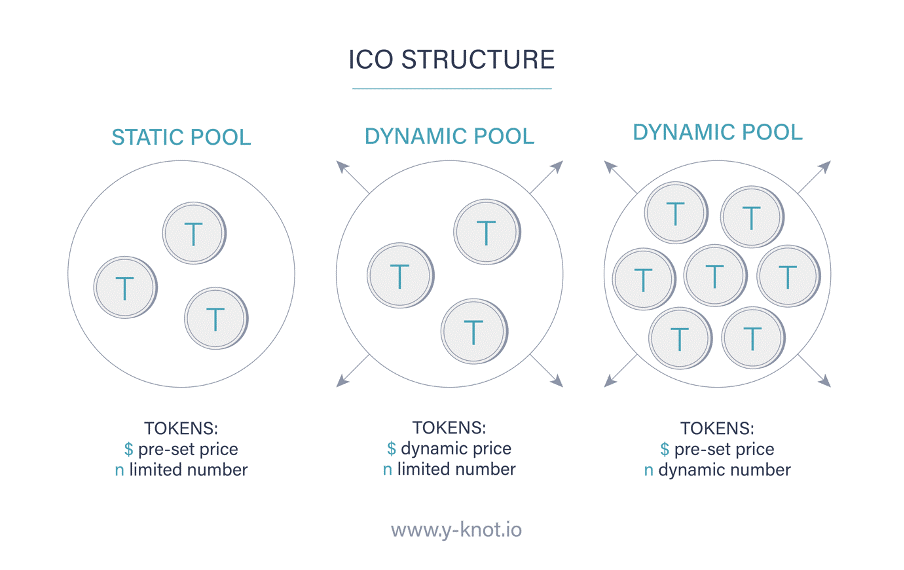

ICO’s can be structured as either static or dynamic pools based on whether the price or number of tokens are limited in the offering. (see the figure below).

Let us consider 3 scenarios which show how ICO’s can be structured:

- A company may set a specific goal or limit its funding. In this case each token is sold in the ICO at a pre-set price, and the total available tokens are limited in number (static).

- A company might have an open funding goal but offer a limited number of tokens. As the funds in the pool increase, the cost per token to investors will increase.

- A company might have an open funding goal, with a dynamic token number, which sets the price of tokens to a pre-set price.

In an IPO, an investor receives shares of stock in a company in exchange for their investment. A company that launches an ICO provides the blockchain equivalent of a share - a token – which represents the value of their stake in the investment. Their stake in the treasure, so to speak.

According to the U.S Securities and Exchange Commission (SEC) [2], an ICO is different from an IPO if the underlying token raises money for an already existing business and does not operate independently of that business. This could mean that an existing company is expanding, designing a new product or investing in technology upgrades to improve their current offering.

ICO tokens can be bought with fiat money (local currencies such as Dollar or Euro), or with a primary cryptocurrency such as Telos (TLOS), Bitcoin or Ether [1]. A token does not have any intrinsic value or legal guarantee (compared to shares), but they are distributed based on the ICO rules (contained within a smart contract).

ICO investors are usually motivated to buy tokens in the hope that the project will succeed. If it does, the value of tokens purchased during that ICO will rise, which means that investors achieve overall gains. Initial coin offerings hold the potential for very high returns, which is its primary benefit.

What to look for in a good ICO opportunity:

Any individual who wants to invest in a company that makes use of ICOs as a means of raising funds should [1]:

- Make sure that the project developers have defined their goals clearly through means of a straightforward, and understandable whitepaper.

- Know the developers or company launching an ICO.

- Look for legal terms and conditions (smart contract) set for the ICO (since ICO are not overseen or regulated).

- Make sure ICO funds are stored in an escrow wallet (a secure vault that holds the funds before they are transferred from one party to another — this is usually managed by a smart contract which releases the funds once all parties fulfilled their contractual requirements).

Where to find ICO opportunities:

Telos launched a new ICO platform in 2021 – T-Starter – the blockchain equivalent of Kickstarter. T-Starter allows the public to easily discover and invest in blockchain projects built on Telos.

T-Starter really raised the game by supporting cross-chain networks that allow you to freely move your T-Starter tokens, called START, between Telos, EOS and WAX, using its bridge technology.

T-Starter is a reliable and lively source of ICO opportunities for those who have the spirit of adventure in them.

In this section we introduced you to Initial Coin Offerings, which take place on token-based platforms. In the next section we will dive deeper into token-based platforms.

References

[1] J. Frankenfield, "Initial Coin Offering (ICO)", Investopedia, 2020. [Online]. Available: https://www.investopedia.com/terms/i/initial-coin-offering-ico.asp. [Accessed: 06- Jul- 2021].

[2] "Spotlight on Initial Coin Offerings (ICOs)", U.S. Securities and Exchange Commission, 2021. [Online]. Available: https://www.sec.gov/ICO. [Accessed: 06- Jul- 2021].